Vice President, Executive Director and General Manager, Lockheed Martin Ventures

July 2020

I once heard someone say that after you take someone’s money “their strategy becomes your strategy.” Having been in the venture capital world for more than 15 years, my advice to startups looking for a strategic partner is: spend time getting to know potential investors and why they are interested in your company and technology. Ultimately, your strategy and the investor’s strategy should align. If you so happen to find the right partner in a corporate-backed fund (like the one I run at Lockheed Martin Ventures), it’s a win-win.

Traditionally, the goal of raising venture capital is to return as much capital as possible to the investors. Corporate-backed investors, however, can have a wide spectrum of strategies. Normally if you’re purely a financial investor, you only care about capital, and if you’re purely a strategic investor, you only care about technology the parent company can eventually acquire. I set up Lockheed Martin Ventures to bridge these two approaches.

At Lockheed Martin Ventures, the first thing we do is screen the emerging technology we’re looking at against the business interests of the corporation. We are looking for what we call “dual use” technologies. However, we’re not a huge fund. We’re a $200 million fund, and we aim to be a minority shareholder in technology startups. Lockheed Martin Ventures wants to tap into these startups, and ultimately serve as a [market/ bridge] for the emerging technology being created outside the walls of the defense industry. Being a minority shareholder means companies will have the space to sell to the entirety of the aerospace and defense sector. That’s a scenario where everyone wins.

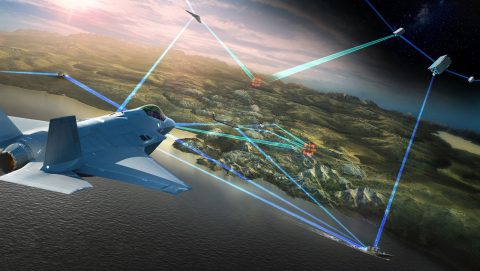

One of our newest portfolio companies is Anello Photonics, a Silicon Valley based startup in stealth mode creating next-generation navigation systems. The CEO Mario Paniccia admitted at the recent Defense One Tech Summit that he is looking to market his technology to the commercial segment eventually. Along the way though, through his relationship with Lockheed Martin, he is getting early access to a huge customer that can provide a lot of integral feedback to the design of the technology. Mario then knows he can take the feedback, make his product “defense worthy” (his words), and still use the foundation to commercialize his product. For Lockheed Martin, we get access to cutting-edge technology from the get-go. We don’t have to wait years to tap into something innovative. So, through these relationships, startups like Anello get early access and feedback from potential defense customers, and we get early access to technology. This drives up Anello Photonics’ value in the commercial space for its dual-use technology.

Now, a big value proposition in the commercial space is not necessarily going to be important to us at Lockheed Martin from an acquisition standpoint. The true value in these types of strategic partnerships is creating relationships and opportunities for startups to become long-term suppliers to us and our customers. Lockheed Martin Ventures also brings something else to the table, thousands of Lockheed Martin engineers who are leaders in their fields worldwide. We are looking to invest in these early phase startups so we can utilize the full spectrum of Lockheed Martin talents through collaboration with these companies. In the end, helping to shape next-generation technology – the technology that reaches beyond imagination – is really beneficial to both defense and commercial industries.

About the Author:

John Christopher “Chris” Moran is the Executive Director and General Manager of Lockheed Martin Ventures; the venture capital investment arm of Lockheed Martin Corporation. In this capacity, he is responsible for leading the Corporation’s investments in small technology companies which support Lockheed Martin’s strategic business objectives.

Prior to joining Lockheed Martin, Chris served in a variety of increasingly responsible positions at Applied Materials, Inc., Santa Clara, CA. He served most recently as the head of the Business Systems and Analytics group in the Applied Global Services Organization. Chris was with Applied for over 32 years. Prior to his most recent role, Chris was head of Corporate Strategy and General Manager of Applied Ventures LLC; the strategic investing arm of Applied Materials.

Chris is a graduate of the Massachusetts Institute of Technology where he obtained both his Bachelor’s and Master’s degrees in Mechanical Engineering.