We’re doubling our investments in early-stage technology companies from $200 million to $400 million.

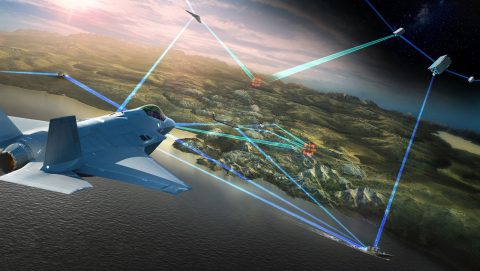

Why? We have a vision to radically improve networked deterrence for our customers.

We see tremendous value in investing in transformative commercial technologies. Small startups need a lot of different capital to grow.

When we invest it’s a win for national security and a win for the startup. Early-stage technology companies get the freedom to push the boundaries of technology while gaining early access to a potential long-term customer.

Simply, we’re helping our customers adopt disruptive, cutting-edge technologies faster to keep Americans and our allies ready for what is ahead.

Our Success? In the venture capital world, an “exit” is when a company you invested in either goes public or is acquired by another company. In 2021, We had numerous successful exits.

Aeva produces sensors to help autonomous vehicles get a multidimensional view of the road.

IonQ is leading the way in quantum computing by using trapped ion technology.

Terran Orbital Al is industrializing small satellite production and building the world's most advanced earth observation constellation.

We plan to reinvest $200 million in profits from these successful exits.

Year to date, Lockheed Martin Ventures has invested in 11 new companies. With double the fund, we aim to double the number of our portfolio companies. Since its inception in 2007, we’ve invested in over 70 companies around the world that will define the future of our industry.