Newsroom Resources ___

Global Activity

Featured

Global Presence, Local Impact

Global Presence, Local Impact

Learn how we are strengthening the economies, industries and communities of our global partner nations.

Who we are

About Us

Leadership & Governance

Our Businesses

Sustainability & Social Impact

Ethics

Economic and Workforce Impact

Global Activities

Leadership & Governance

Executive Leadership Team

Full Spectrum Leadership

Corporate Governance

Board of Directors

Corporate Charter

Political Disclosures

Our Businesses

BUSINESS AREAS

Aeronautics

Missiles and Fire Control

Rotary and Mission Systems

Space

INNOVATION & INVESTMENT

LM Evolve

LM Ventures

Social Impact

In the Community

Military and Veteran Support

Future STEM Workforce

Employee Focused Programs

Volunteerism

Contribution Process

Sustainability

Sustainability at LM

Sustainability Performance Report

Sustainability Management Plan

Sustainability Governance Plan

What We Do

Aircraft

All-Domain Operations

Autonomy & AI

Cyber

Deterrence Capabilities

Maritime Systems

Mission Integration

Space

Sustainment & Training Systems

Transformative Technology

Products by Domain

Featured

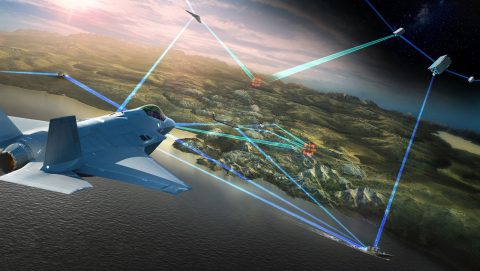

21st Century Security®

21st Century Security®

Designed to help the U.S. and allies leverage emerging technologies to create a resilient multi-domain network.

Autonomy & AI

AI

Artificial Intelligence

AI Fight Club™

STAR.OS Integration Framework

AUTONOMY

Autonomy

Distributed Teaming

View All Products

Aircraft

Air Dominance

Fixed Wing

Autonomous Aircraft

Commercial Aircraft

Fighter Jets

Tactical Airlift

Tanker Transport

Rotary Wing

Sikorsky

Autonomous Aircraft

Black Hawk Family

Commercial Aircraft

Explore All Aircraft

All-Domain Operations

21st Century Security®

C4ISR Solutions

Joint All-Domain Operations

Mission Integration

Aircraft

Fixed Wing

Autonomous Aircraft

Commercial Aircraft

Fighter Jets

Tanker Transport

Rotary Wing

Sikorsky

Autonomous Aircraft

Black Hawk Family

Commercial Aircraft

Innovation

Skunk Works®

Global Research and Development

Advanced Technology Center

Advanced Technology Laboratories

Center for Innovation

Sikorsky Innovations

STELaRLab

Space Capabilities

Communications Security

Deterrence & Missile Defence

Global Situational Awareness

Human & Scientific Exploration

Intelligence Solutions & Cyber

Space Technologies

Deterrence Capabilities

Air Dominance

C4ISR Solutions

Counter-Unmanned Aerial Systems

Cyber Solutions

Directed Energy

Electronic Warfare

Hypersonics

Integrated Air & Missile Defense

Joint All-Domain Operations

Radar

Sensors

Undersea Warfare

Weapon Systems

Space

All Space Capabilities

Deep Space Exploration

Human Space Exploration

National Security Space

Strategic & Missile Defense Systems

Weather & Earth Science

Transformative Technologies

21st Century Security®

5G.MIL Solutions

Artificial Intelligence

Cyber

Directed Energy

Firefighting Intelligence

Hypersonic Solutions

Innovation in Defense

Spectrum Dominance

Our Business Innovation

Digital Transformation

Research Labs

Research Labs

Skunk Works®

Global Research and Development

Advanced Systems and Technologies - AU

Advanced Technology Center

Advanced Technology Laboratories

Center for Innovation

Sikorsky Innovations